What is 2-step Verification?

2-step Verification (2SV) is an industry standard that helps safeguard money against many types of fraud. It offers more protection for your WealthONE accounts by creating an extra barrier that’s harder for cybercriminals to break through. Setting up 2SV is an important step towards keeping your accounts safer.

How it works?

2-step Verification (2SV) works as an extra step to protect your account by sending you dynamically generated one-time verification codes after you type in your username and password. The verification code will be sent to your chosen trusted device (SMS messages or emails) whenever someone tries to sign in from another device. If the person trying to sign in is not you, you can then stop them from accessing your account. Because of the brief duration of the use of generated verification codes, they are inherently more secure than regular challenge questions and answers. When 2SV is set up, even if someone has your username and password, they won’t be able to access your account without getting through this extra barrier. It is also easier to use as you don't have to worry about forgetting the answers to your challenge questions!

Enrol in 2-step Verification

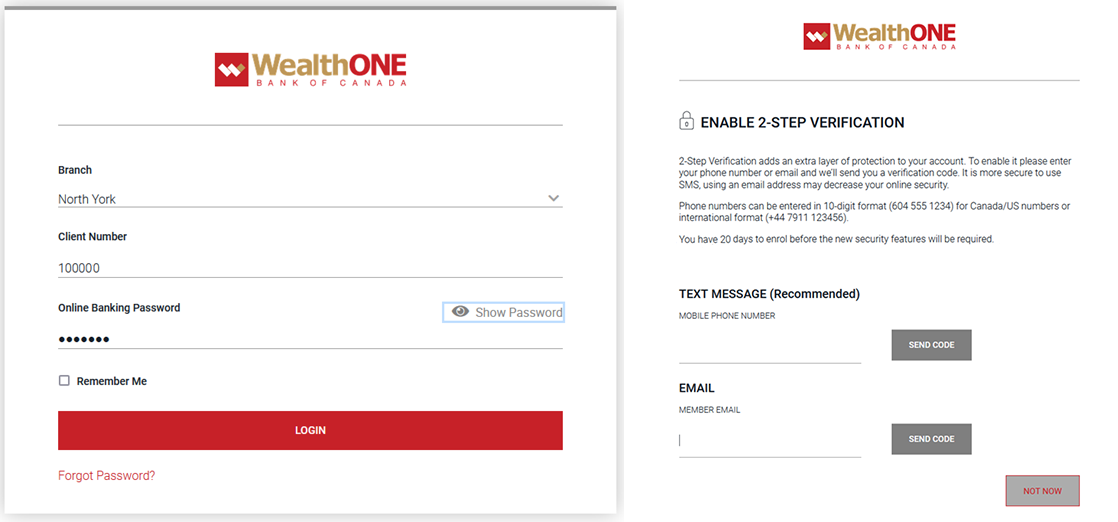

The implementation of 2SV is a mandatory requirement for all our valued customers. Starting June 20th you will be able to set up your 2-step Verification (2SV) on the desktop or mobile app. When you log into online or mobile banking, you will be presented with an ENABLE 2-STEP VERIFICATION enrolment screen. Simply follow the on-screen instructions to set up your 2-step Verification in only a couple of minutes. Please ensure that you have your Client Number and Password readily available before you do. You can find your Client Number on your statement. If you are unable to locate your Client Number or Password, please don't hesitate to contact us at 1.866.392.1088, Monday to Friday, 9am to 5pm (EST.), we will assist you in securely retrieving your information. You can also book an appointment with us for 2SV related questions.

Here are some important dates to keep in mind:

June 20th: You can begin the process of setting up your 2-step Verification (2SV).

July 5th: Deadline Alert - Make sure to set up your 2-step Verification (2SV) before July 5th. Failure to complete the setup by this date will result in restricted access to your account until you finish the 2SV process.

For Online Banking

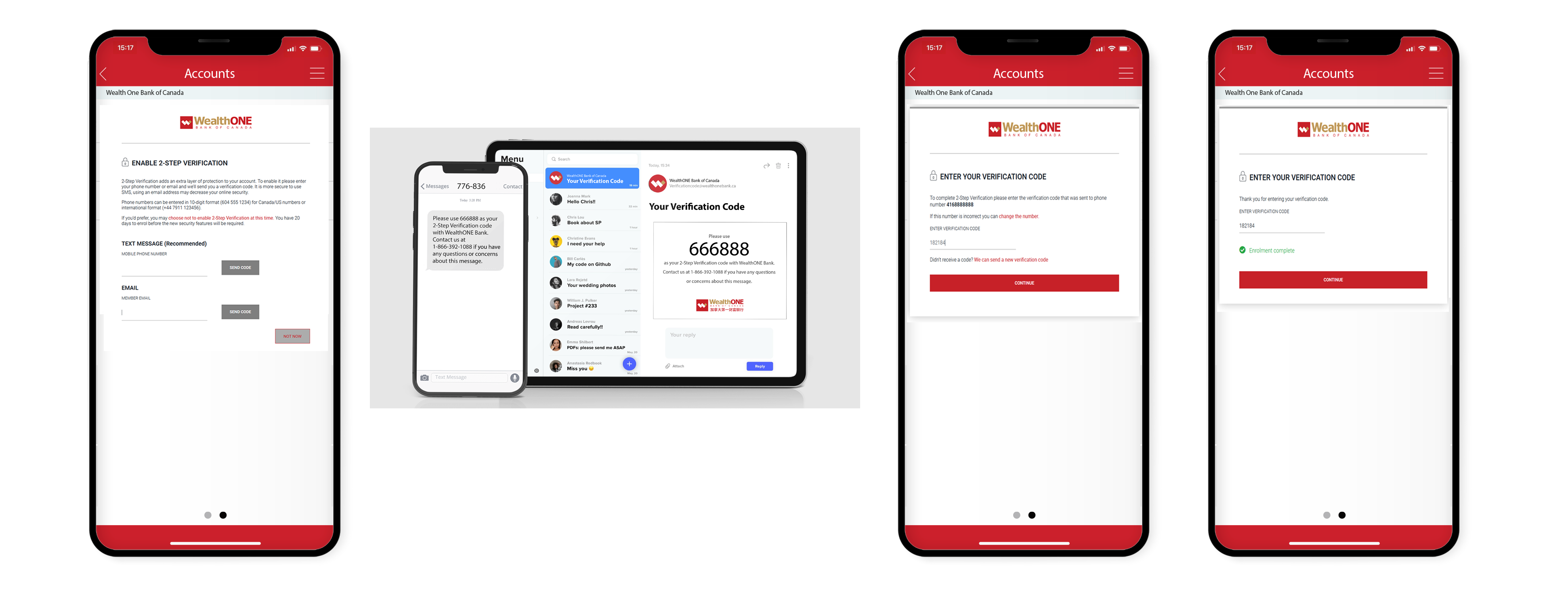

Step 1: Log into your account on the WealthONE online banking page. Choose to receive the one-time verification code through text message or email (we recommend text message). Type in your phone number or email address and click SEND CODE.

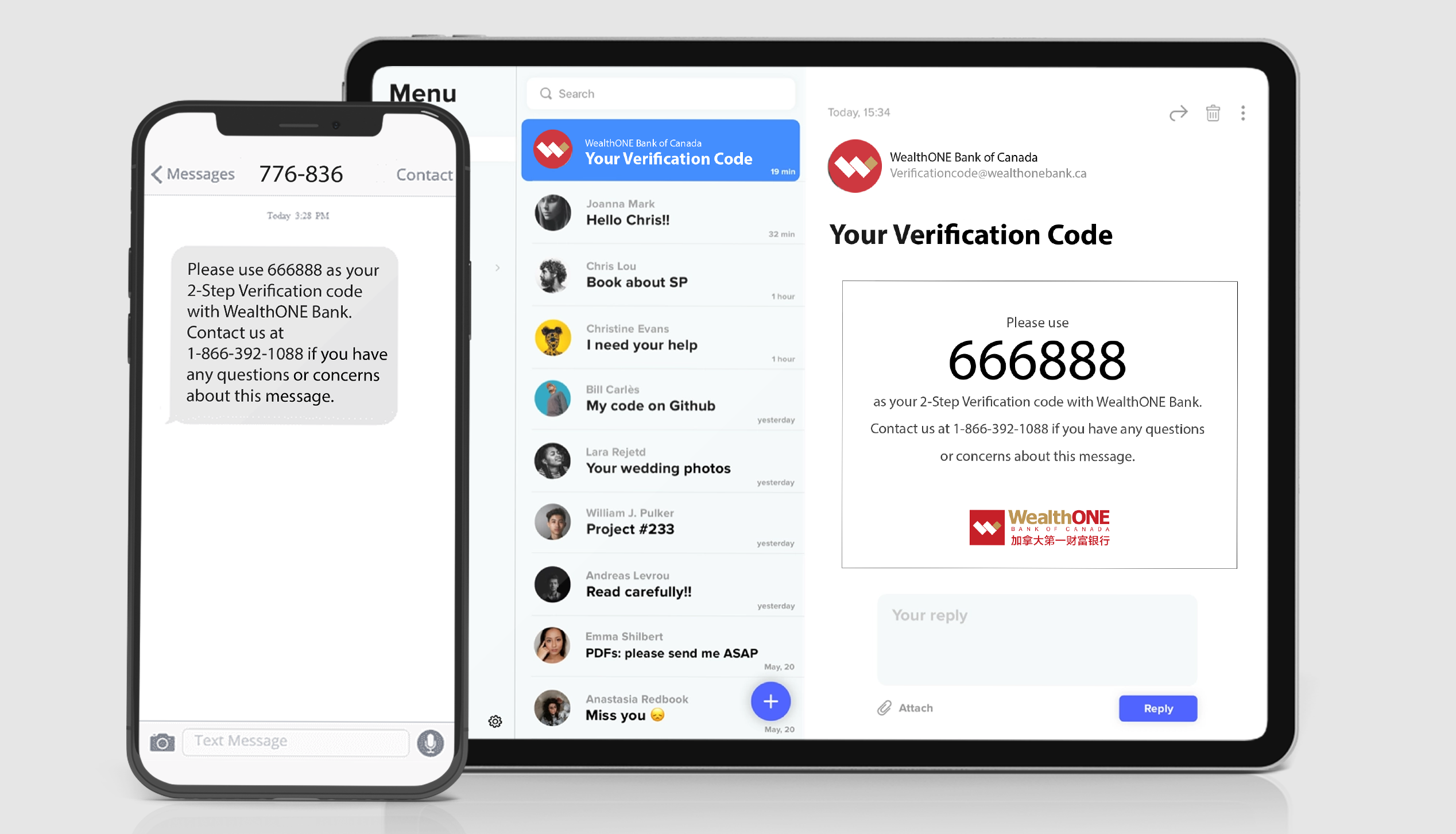

Step 2: When selecting SEND CODE, a verification code is then sent as a text message to your mobile phone or an email to your email address.

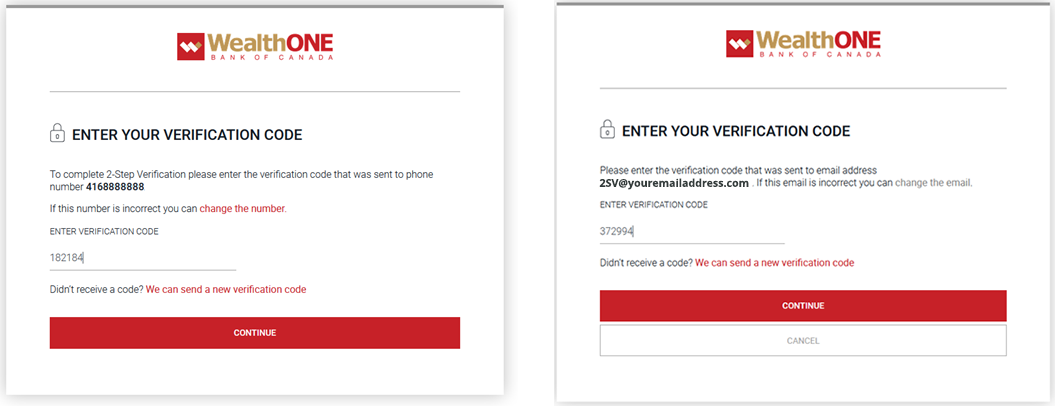

Step 3: Retrieve the code from the notification and enter it on the ENTER YOUR VERIFICATION CODE screen. Once the verification code is entered, select CONTINUE to submit the code for verification.

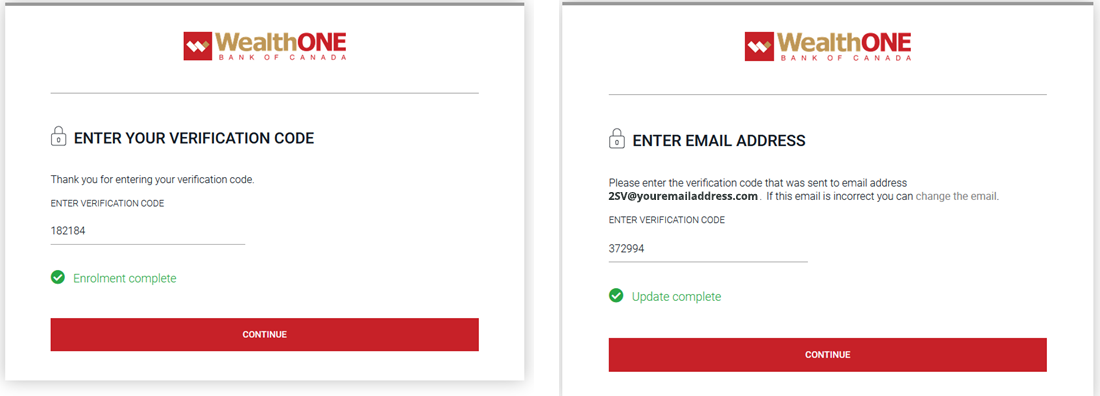

Step 4: When the submitted verification code is verified, the ENTER YOUR VERIFICATON CODE screen is updated with the message ENROLMENT COMPLETE, confirming that the enrolment was successful, and you can now go to your online or mobile banking by selecting CONTINUE.

After successfully enroling in 2-step Verification, each time you log into your account, you will be presented with the Enter Your Verification Code verification screen (Starts after July 5th). In the case of dual registrations, where you have registered both a mobile phone number and an email address for verification code notifications, during step-up authentications, you will be asked to select which channel - text message or email - that you want the notification sent through before the notification is dispatched.

For Mobile Banking App

Enroling in 2-step Verification on your mobile banking app is the same to that on the online banking system. The first time you login into your mobile banking app, you will be presented with an ENABLE 2-STEP VERIFICATION enrolment screen, where you then choose your preferred way of receiving the one-time verification code (text message or email).

Action Required: To set up and enable 2SV on your mobile app, you will need to update the mobile app to the latest version. The update includes the necessary changes and improvements to support this new security feature.

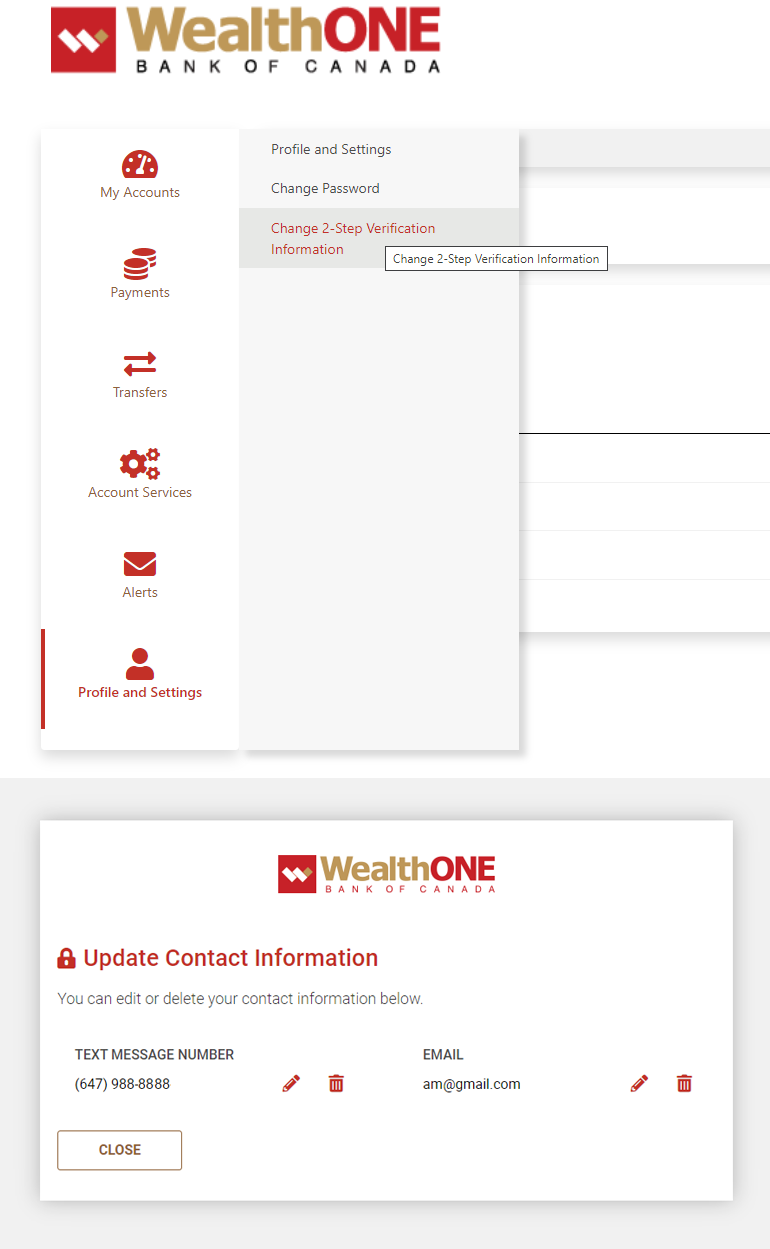

Edit phone number or email address

Any time after enrolment, you can add or edit the mobile phone number and/or email address used in 2SV notifications through online banking or mobile banking app. After logging in, click PROFILE AND PREFERENCES in online banking or SECURITY in mobile banking to add or edit your 2SV settings.

Keep your verification code to yourself

Please always keep in mind that you should never give the verification code to people you don't know, same as your personal or financial information including your bank account number, passwords or SIN. WealthONE will never phone, email or text you to acquire the one-time verification code you need to log into your account.

More ways to bank

Bank online, on your mobile device, or talk to one of our representatives.